Make Your Clients Cyber Insurance Ready — the Easy Way

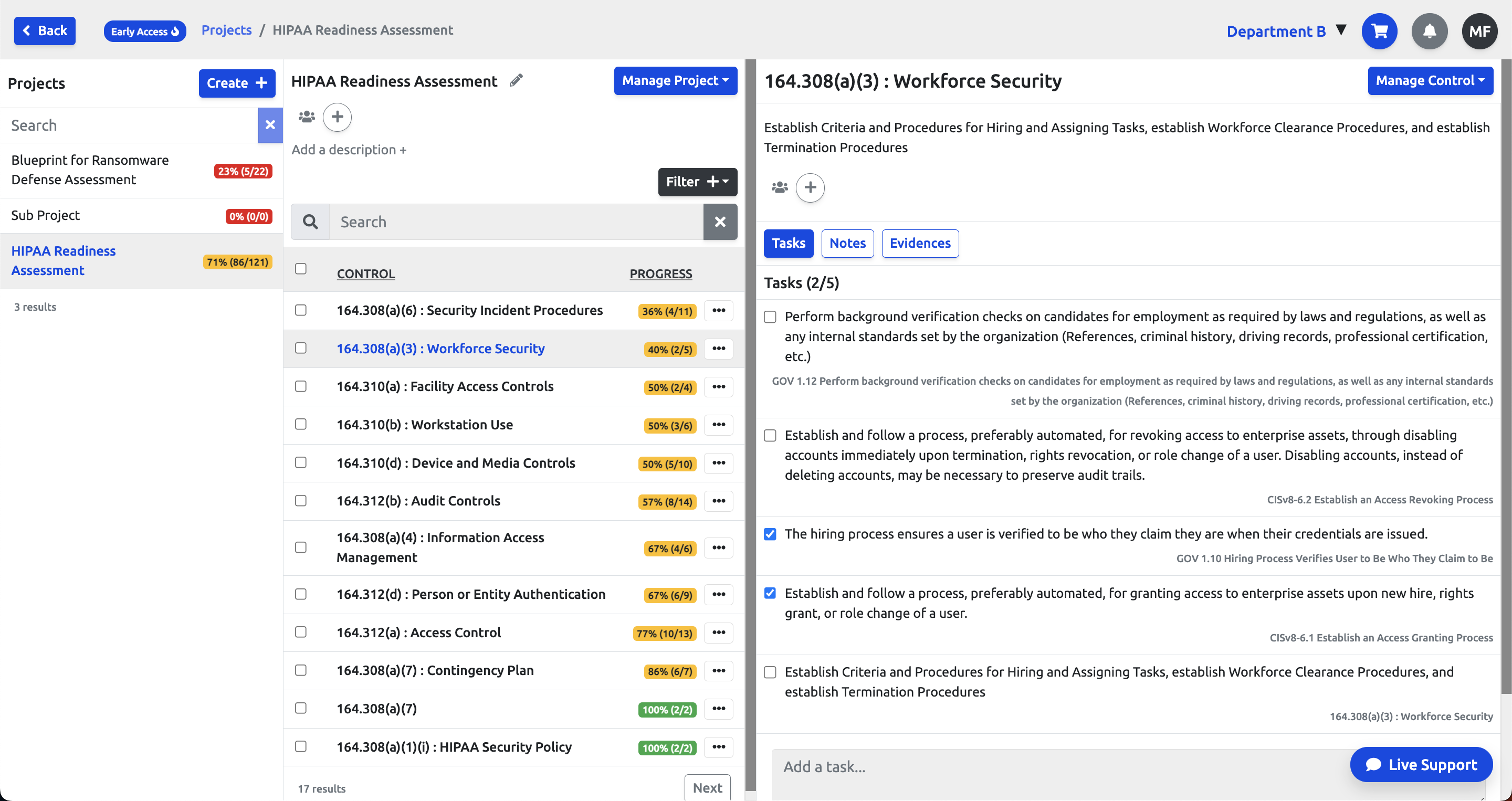

Cyber insurance underwriters are raising the bar. RealCISO’s Cyber Insurance Dashboard ensures your clients meet those requirements by assessing against insurer-specific controls, identifying gaps, and even auto-filling application forms.